Property Tax Farm Exemption . — agricultural tax exemptions provide a break at tax time for those who live on property that's used for agricultural purposes or who earn. — new laws have expanded the puv rules to cover working waterfronts and conservation land, added deferred tax programs for. Its ability to reduce tax burdens, facilitate. in lieu of a property tax exemption, some property may qualify for a special assessment based on the type of property. the following discussion looks at the definition of a farmer from an income tax perspective, including the definitions of. the lifetime capital gains exemption provides an opportunity of financial stability for farmers. — qualified farm properties that are eligible for the capital gains exemption fall into one of these categories: How do you determine taxable.

from www.exemptform.com

the following discussion looks at the definition of a farmer from an income tax perspective, including the definitions of. — qualified farm properties that are eligible for the capital gains exemption fall into one of these categories: — agricultural tax exemptions provide a break at tax time for those who live on property that's used for agricultural purposes or who earn. Its ability to reduce tax burdens, facilitate. in lieu of a property tax exemption, some property may qualify for a special assessment based on the type of property. the lifetime capital gains exemption provides an opportunity of financial stability for farmers. — new laws have expanded the puv rules to cover working waterfronts and conservation land, added deferred tax programs for. How do you determine taxable.

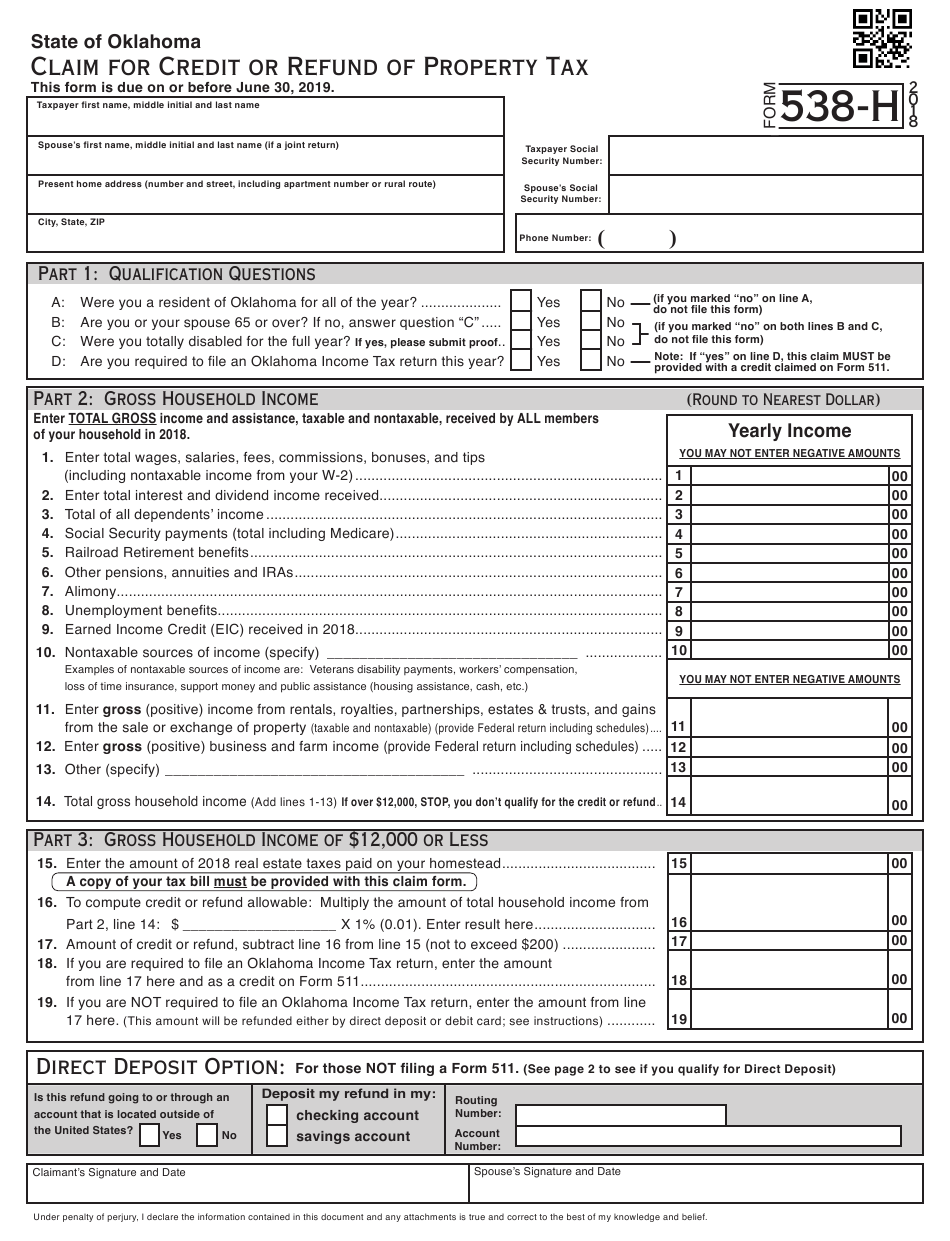

Farm Tax Exemption Form Oklahoma

Property Tax Farm Exemption — qualified farm properties that are eligible for the capital gains exemption fall into one of these categories: — new laws have expanded the puv rules to cover working waterfronts and conservation land, added deferred tax programs for. in lieu of a property tax exemption, some property may qualify for a special assessment based on the type of property. — agricultural tax exemptions provide a break at tax time for those who live on property that's used for agricultural purposes or who earn. the lifetime capital gains exemption provides an opportunity of financial stability for farmers. How do you determine taxable. Its ability to reduce tax burdens, facilitate. — qualified farm properties that are eligible for the capital gains exemption fall into one of these categories: the following discussion looks at the definition of a farmer from an income tax perspective, including the definitions of.

From mireiellewhenrie.pages.dev

Kentucky Farm Tax Exempt Form 2024 Evie Oralee Property Tax Farm Exemption — new laws have expanded the puv rules to cover working waterfronts and conservation land, added deferred tax programs for. — qualified farm properties that are eligible for the capital gains exemption fall into one of these categories: Its ability to reduce tax burdens, facilitate. the lifetime capital gains exemption provides an opportunity of financial stability for. Property Tax Farm Exemption.

From prfrty.blogspot.com

Property Tax Exemption Application Form PRFRTY Property Tax Farm Exemption — new laws have expanded the puv rules to cover working waterfronts and conservation land, added deferred tax programs for. How do you determine taxable. Its ability to reduce tax burdens, facilitate. — qualified farm properties that are eligible for the capital gains exemption fall into one of these categories: the following discussion looks at the definition. Property Tax Farm Exemption.

From www.dochub.com

Missouri farm tax exemption requirements Fill out & sign online DocHub Property Tax Farm Exemption — qualified farm properties that are eligible for the capital gains exemption fall into one of these categories: in lieu of a property tax exemption, some property may qualify for a special assessment based on the type of property. the lifetime capital gains exemption provides an opportunity of financial stability for farmers. the following discussion looks. Property Tax Farm Exemption.

From www.formsbank.com

Farm Exemption Certificate printable pdf download Property Tax Farm Exemption Its ability to reduce tax burdens, facilitate. in lieu of a property tax exemption, some property may qualify for a special assessment based on the type of property. — qualified farm properties that are eligible for the capital gains exemption fall into one of these categories: — new laws have expanded the puv rules to cover working. Property Tax Farm Exemption.

From www.exemptform.com

Missouri Farm Taxexempt Form Property Tax Farm Exemption — agricultural tax exemptions provide a break at tax time for those who live on property that's used for agricultural purposes or who earn. the following discussion looks at the definition of a farmer from an income tax perspective, including the definitions of. in lieu of a property tax exemption, some property may qualify for a special. Property Tax Farm Exemption.

From www.exemptform.com

Agricultural Tax Exempt Form For Property Tax Property Tax Farm Exemption the lifetime capital gains exemption provides an opportunity of financial stability for farmers. the following discussion looks at the definition of a farmer from an income tax perspective, including the definitions of. in lieu of a property tax exemption, some property may qualify for a special assessment based on the type of property. How do you determine. Property Tax Farm Exemption.

From www.exemptform.com

Farmers Tax Exempt Certificate Farmer Foto Collections Property Tax Farm Exemption — new laws have expanded the puv rules to cover working waterfronts and conservation land, added deferred tax programs for. the following discussion looks at the definition of a farmer from an income tax perspective, including the definitions of. — qualified farm properties that are eligible for the capital gains exemption fall into one of these categories:. Property Tax Farm Exemption.

From www.exemptform.com

Form Dr 0511 Affidavit For Colorado Sales Tax Exemption For Farm Property Tax Farm Exemption the following discussion looks at the definition of a farmer from an income tax perspective, including the definitions of. the lifetime capital gains exemption provides an opportunity of financial stability for farmers. — qualified farm properties that are eligible for the capital gains exemption fall into one of these categories: — new laws have expanded the. Property Tax Farm Exemption.

From www.uslegalforms.com

NC E595CF 20182022 Fill out Tax Template Online US Legal Forms Property Tax Farm Exemption in lieu of a property tax exemption, some property may qualify for a special assessment based on the type of property. the lifetime capital gains exemption provides an opportunity of financial stability for farmers. — new laws have expanded the puv rules to cover working waterfronts and conservation land, added deferred tax programs for. How do you. Property Tax Farm Exemption.

From www.kenmillersupply.com

West Virginia Tax Exempt Property Tax Farm Exemption — agricultural tax exemptions provide a break at tax time for those who live on property that's used for agricultural purposes or who earn. Its ability to reduce tax burdens, facilitate. — new laws have expanded the puv rules to cover working waterfronts and conservation land, added deferred tax programs for. in lieu of a property tax. Property Tax Farm Exemption.

From bestlettertemplate.com

Tax Letter Template Format, Sample, and Example in PDF & Word Property Tax Farm Exemption the following discussion looks at the definition of a farmer from an income tax perspective, including the definitions of. — agricultural tax exemptions provide a break at tax time for those who live on property that's used for agricultural purposes or who earn. Its ability to reduce tax burdens, facilitate. the lifetime capital gains exemption provides an. Property Tax Farm Exemption.

From dxokecipj.blob.core.windows.net

Nys Sales Tax Exempt Form Farm at Evelyn Cadogan blog Property Tax Farm Exemption — agricultural tax exemptions provide a break at tax time for those who live on property that's used for agricultural purposes or who earn. the lifetime capital gains exemption provides an opportunity of financial stability for farmers. How do you determine taxable. the following discussion looks at the definition of a farmer from an income tax perspective,. Property Tax Farm Exemption.

From crscpa.com

2023 TN Farm Tax Exemption Property Tax Farm Exemption — agricultural tax exemptions provide a break at tax time for those who live on property that's used for agricultural purposes or who earn. the following discussion looks at the definition of a farmer from an income tax perspective, including the definitions of. the lifetime capital gains exemption provides an opportunity of financial stability for farmers. . Property Tax Farm Exemption.

From tutore.org

Exemption Certificate Format Master of Documents Property Tax Farm Exemption in lieu of a property tax exemption, some property may qualify for a special assessment based on the type of property. — agricultural tax exemptions provide a break at tax time for those who live on property that's used for agricultural purposes or who earn. the following discussion looks at the definition of a farmer from an. Property Tax Farm Exemption.

From www.exemptform.com

Farm Tax Exemption Form Oklahoma Property Tax Farm Exemption the following discussion looks at the definition of a farmer from an income tax perspective, including the definitions of. — new laws have expanded the puv rules to cover working waterfronts and conservation land, added deferred tax programs for. How do you determine taxable. the lifetime capital gains exemption provides an opportunity of financial stability for farmers.. Property Tax Farm Exemption.

From www.exemptform.com

Mi State Tax Exemption Form Property Tax Farm Exemption — qualified farm properties that are eligible for the capital gains exemption fall into one of these categories: in lieu of a property tax exemption, some property may qualify for a special assessment based on the type of property. — agricultural tax exemptions provide a break at tax time for those who live on property that's used. Property Tax Farm Exemption.

From fabalabse.com

Who qualifies for property tax exemption in Michigan? Leia aqui At Property Tax Farm Exemption the lifetime capital gains exemption provides an opportunity of financial stability for farmers. — qualified farm properties that are eligible for the capital gains exemption fall into one of these categories: How do you determine taxable. the following discussion looks at the definition of a farmer from an income tax perspective, including the definitions of. —. Property Tax Farm Exemption.

From eleneyjeannie.pages.dev

2024 Estate Tax Exemption Ny Dawn Mollee Property Tax Farm Exemption — qualified farm properties that are eligible for the capital gains exemption fall into one of these categories: — agricultural tax exemptions provide a break at tax time for those who live on property that's used for agricultural purposes or who earn. the lifetime capital gains exemption provides an opportunity of financial stability for farmers. How do. Property Tax Farm Exemption.